The year 2015 turned out to be a success one for the CS company despite the crisis of the Ukrainian banking sector: CS obtained new customers and partners and implemented all planned projects.

New customers and projects

In 2015 CS obtained 3 new customers – PIVDENNYI Bank, CreditWest Bank and ComInBank.

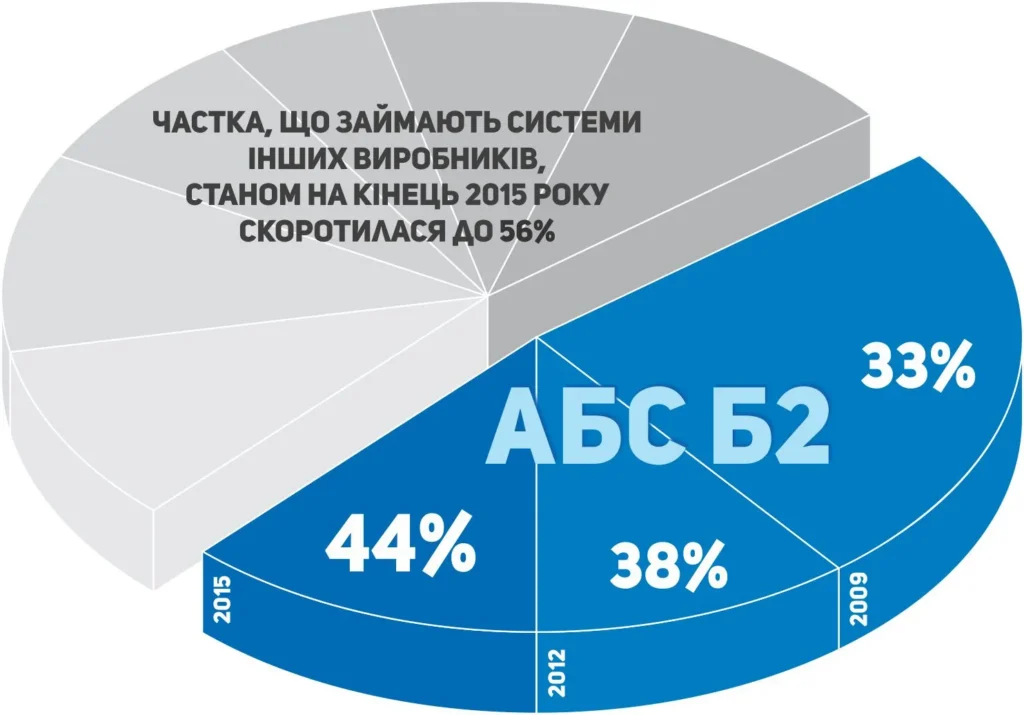

All three banks chose CBS B2 as their core banking system. It enabled CS to increase market share.

CBS B2 market share in 2009-2015

Apart from CBS B2 the system of human resources management and payroll preparation (HRM&Payroll::eCSpert) was implemented in ComInBank.

In its turn, PIVDENNYI Bank started to operate – CBS B2 web client, iFOBS online banking system, iB2 system of the single account and CS::BI analytical system.

Also CS implemented many other projects in 2015.

Among them there were two big projects on Platinum Bank and OTP Bank transfer to a new processing.

iFOBS.WebPrivate – online banking system for private customers was also implemented in OTP Bank.

In 2015 PJSC “AgroComBank” has become the seventh bank which implemented the iFOBS.Mobile online banking by the CS company. Now customers of AgroComBank can use the bank services without turning on their computers – a smartphone running on iOS or Android is enough.

New solutions

Cash module

«Cash module» of CBS B2 web-client enables to control of given out cash to bank tellers on condition of accountability and cash balance on hand. It also reduces customer service time and decreases communication channels load between bank’s main office and its branches.

Now two banks in Ukraine use this module – PIVDENNYI Bank and Kredobank.

CS BPM

CS BPM – it’s a flexible and effective instrument for banks’ business processes managing. Process Builder allows you to retrieve data from external sources, to build decision-making processes, to consider the possibility of lending, in particular, by carrying on the analysis of loan applications and routing them between the units of the bank.

Raiffeisen Bank Aval became the first user of CS BPM.

PolisOK

PolisOK – free application for insurance intermediaries, which allows you to calculate the cost of liability insurance policy of the driver. The program is available for use by any agent of the insurance company.

Mobile application PolisOK is available for OS Android, starting with version 4.0: https://play.google.com/store/apps/details?id=com.csltd.polisok

New partners

In 2015 CS started to cooperate with Dell – an American privately owned multinational computer technology company. Partnership with Dell gives an opportunity to receive special price conditions and access to partnership training.

Events

In 2015 CS was a participant and sponsor of many partner events.

In April CS made a presentation “Security of Internet banking: from blissful ignorance to comfortable confidence” within the bounds of “Bank Security” international conference that was held in Prague.

Three outstanding events were in June, 2015:

- ODTUG Kscope15 (Hollywood, USA) – an international conference for Oracle developers, where Eugene Fedorenko, CS senior analyst made a presentation «Mastering Oracle ADF Bindings advanced techniques»;

- Banking Congress in Ukraine – international event for bankers (Kyiv, Ukraine);

- III International Conference “Customer Service in the Bank: How to Attract and Keep Customers?” (Barcelona, Spain), where Alexander Pogulyaka, head of security solutions department for online banking systems, made a presentation on the role of good and convenient remote service being one of the main service channels in the modern bank.

In Autumn CS presented its solutions for the Georgian banking sector in Tbilisi, took part in Ukrainian Banking Forum – CIS Bankers 12 as a sponsor and traditionally sponsored the Oracle Innovation Day.

Apart from partner events CS held 6 specialized seminars for bankers and the XII Banking conference “Banking automation” – the traditional event for professionals in the field of banking software who are united by the wish to reach the high business performance.

Dmytro Radchenko, director of the CS company:

The year 2015 was a complicated one, nevertheless, I would like to mention that all our plans were successfully executed. We have achieved desired goals and keep developing.