We recently published news about the implementation of BTT 3.0, in which we promised to provide more detailed information about the system’s capabilities, and especially about the features of the new version. Here is the announced article.

The Origins of the BTT System. Web Version 1.0

Today, BTT is a system for supporting the full cycle of development and maintenance of software products. The system was created in the early days of CS company for one of our partners and was an online application for tracking customer requests and feedback. After some time, it became clear that the application’s capabilities would also be useful for us internally.

Previously, our interaction with customers was conducted solely via email and phone. With the introduction of BTT, it became possible to manage all communication within requests, comprehensively track each customer incident, and collaborate on incidents, continuously developing and improving this interaction.

Over time, we began using the application to track our employees’ working hours, which allowed us to analyze completed work by direction, volume, and time spent.

The Development of BTT. Win32 Interface 2.0

As BTT became integrated into our software development processes, we required a multitude of new parameters. It became clear that the existing application architecture needed improvement. Thus, the next version of BTT was born – a Win32 application.

The Win32 interface introduced many tools to simplify and accelerate the process of software product development and customer interaction. For example, new features included registering phone calls with the simultaneous ability to create requests based on those calls. It became possible to create work plans for requests linked to specific employees. Furthermore, in the Win32 application, we implemented the ability to manage projects and sub-projects, grouping requests within them hierarchically.

Capabilities of the New BTT. Web Version 3.0

With a significant increase in the number of BTT users and the expansion of its functionality, we began considering the creation of a new system version. In 2019, we decided to develop the BTT 3.0 web application based on the new core of the ABS B2 system – B2ng (Angular and Spring). And today, CS company has deployed the new version for banks to use.

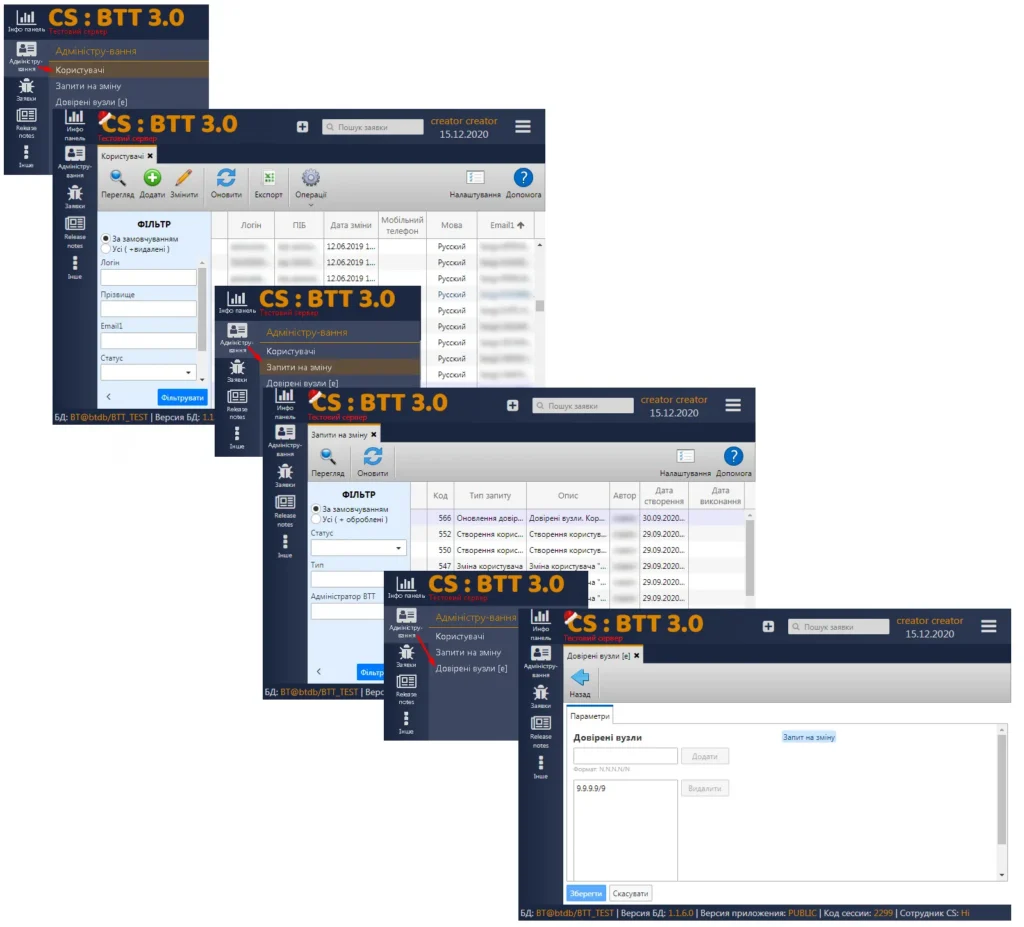

The BTT 3.0 application is built on modern development technologies and features a new, improved user interface. The first new function implemented in BTT 3.0 was the ability for customers to independently administer their own users. This is particularly relevant for large banking structures with a high number of employees using BTT.

At the same time, we prioritized security: a portion of the administrative functions delegated to the customer is additionally approved by our side through responses to automated requests. These functions include:

- Creating a user and granting them rights to specific software products;

- Modifying a user, updating their details;

- Deleting a user;

- Updating information about trusted nodes – the customer’s IP addresses.

Short-term and Long-term Plans

In the near future, we plan to implement the ability for users to confirm the chargeable status of requests and to migrate the entire set of functionalities from the previous web version to the new application. Also, we are currently updating the request design to make working with them more comfortable for the client.

The BTT 3.0 interface is in Ukrainian; the implementation of a multilingual system interface is planned for the future.

Our long-term plans:

- Migrating the functionality from the Win32 interface to BTT 3.0.

- Implementing enhancements for resource and plan accounting to manage workload schedules and shifts for the Support Department employees, and to manage personal plans.

- Developing an incident investigation module for their analysis.

- Implementing two-factor authentication.

The BTT system has evolved and continues to evolve and improve alongside us, and for you.