TRUSTED BY

Both large systematic banks and small financial companies use CS solutions. The flexibility of settings and attention to the individual needs of each institution is one of the main reasons why our clients choose CS::Custody and our other products.

AUTOMATION AND RELIABILITY

<pCS::Custody effectively integrates with ABS B2, simplifying the entry and editing of depositor profiles and ensuring accurate synchronization of financial records. This significantly reduces the risk of errors and improves data processing.

The system maintains active and passive accounts, creates precise accounting entries, and automatically generates reports on account status and operations, ensuring a high level of transparency.

Integration with the "Subscription Fees and Commissions" ABS B2 subsystem allows for automatic calculation of commissions and generation of payment documents, improving financial management efficiency.

AUTONOMOUS SECURITIES MANAGEMENT

CS::Custody offers a unique ability to confidentially store accounting data of securities depositors at the institutional level, without the need to disclose this information to the National Depository.

The system architecture is designed to be self-sufficient and provides complete internal control over all processes.

INTEGRATION WITH CBS B2 AND ITS SUBSYSTEMS

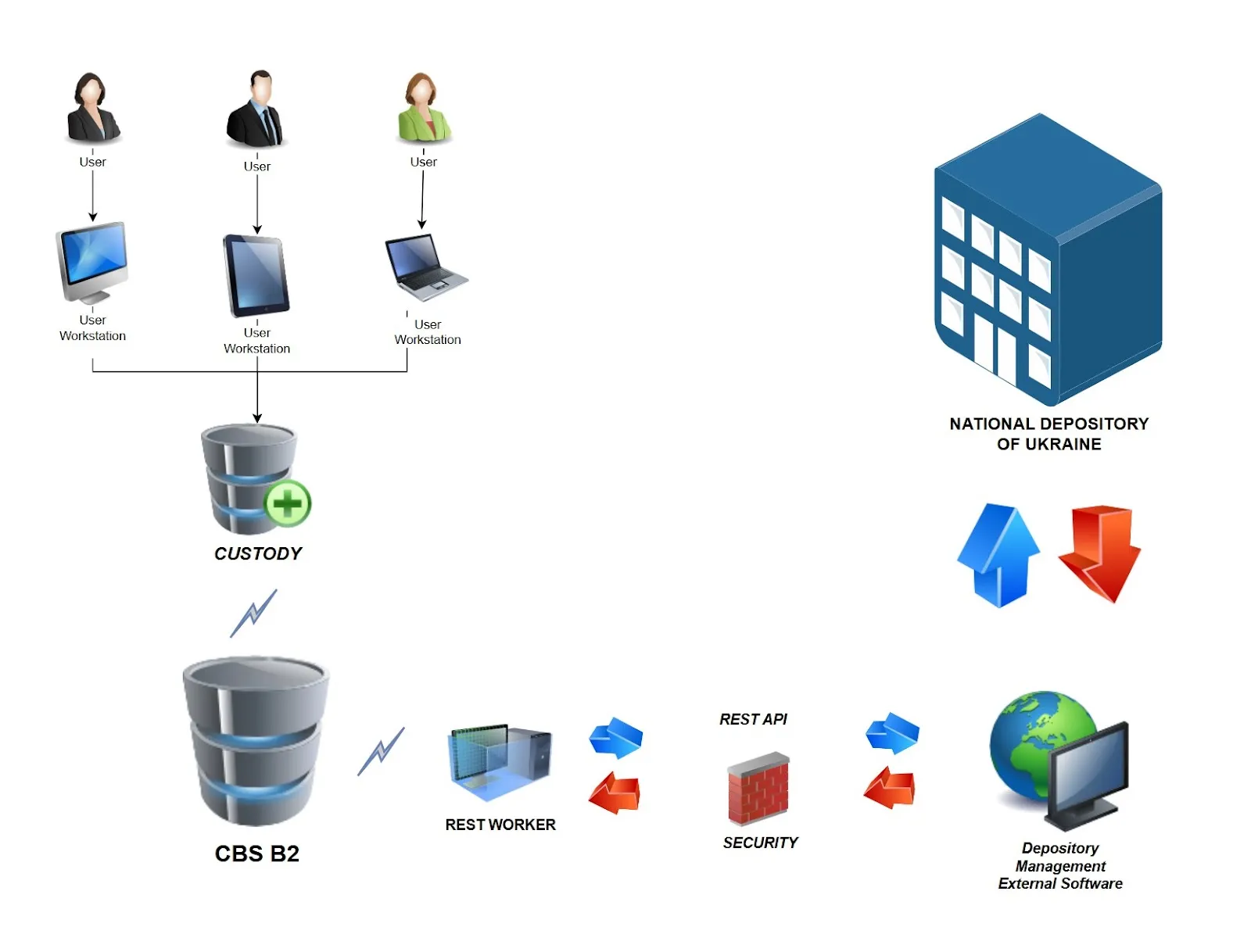

Automation of client data entry, calculation of securities transaction commissions, customer identification through the Diia application – all this is possible thanks to the integration of CS::Custody with CBS B2 and its individual modules.

EXTERNAL SYSTEM INTEGRATION

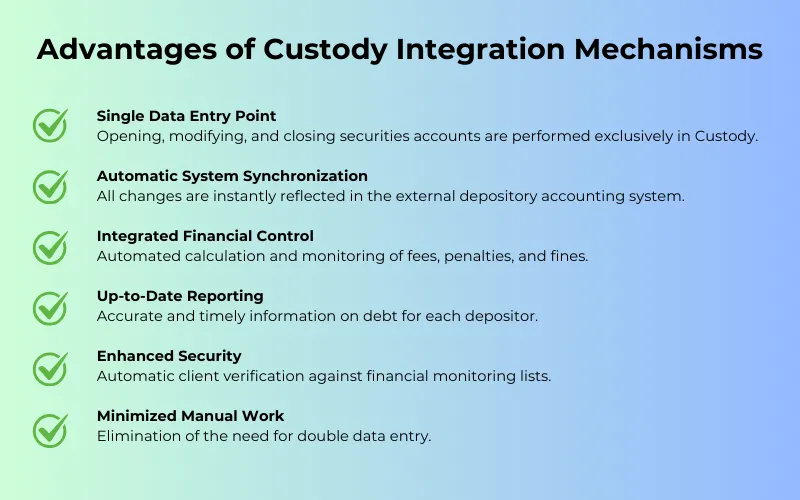

CS::Custody seamlessly integrates with external custodial accounting systems, enabling automatic information exchange. This integration eliminates manual data entry and redundant processes. When changes are made to securities accounts, the system automatically synchronizes the data across external platforms.

By automating the calculation of commissions, penalties, and fees, the solution significantly improves operational efficiency. It enhances accuracy, increases transparency, accelerates transaction processing, and minimizes the risk of human error.

WHO IS THIS SERVICE FOR?

-

A robust system with high reliability, fully compliant with contemporary industry standards.

-

An intuitive web interface that enables swift user training and adoption.

-

Seamless optimization of interactions between internal and external systems.

-

Flexible user access management with configurable rights for operators and verifiers.

-

Intelligent error reduction through elimination of redundant data entry.

-

Highly adaptable solution that can be tailored to specific customer requirements.

SOLUTION ADVANTAGES

# NEWS

CS Company has completed the development and successfully implemented an integration package for the Custody module, significantly expanding its capabilities for interaction with external depository accounting systems. The first implementation has already been successfully realized in one of the partner banks, confirming the effectiveness of the new solution.

The new functionality is primarily designed for commercial banks that maintain depository accounting in external systems (particularly, Zberigach 2016 software from Dekra company) while simultaneously using B2 banking system for their core banking operations.

The enhanced functionality provides comprehensive data exchange when working with securities accounts. When opening an account in the Custody module, information is automatically transmitted to the external system, where necessary regulatory procedures are performed, such as creating an account owner’s card. Similarly, data synchronization occurs when modifying account parameters and during account closure.

The process of closing securities accounts has been significantly improved. The system now performs multi-level verification of closure possibility: analyzing account balances, checking client’s commission debts, and receiving additional verification parameters from the external system. This ensures the correctness of the closure procedure and compliance with all regulatory requirements.

An important aspect of the new development is the improvement of mechanisms for handling depository service commissions. Two-way information exchange has been implemented: the external system transmits data about accrued commissions to the Subscription and Commission subsystem of B2 banking system, which, in turn, monitors commission payments and transmits information about received funds back to the depository accounting system.

The automation of depository service commission accounting in B2 banking system is crucial for the bank’s risk management. Detailed accounting of client debts across depository services allows the bank to consider this data when calculating credit risk in accordance with NBU Regulation #351 requirements and forming reserves.

As part of financial accounting improvements, automated calculation of penalties and fines for overdue debts has been implemented. Current amounts of penalties and fines for each depositor are automatically transmitted to the external depository accounting system, enabling the generation of correct invoice acts at any time.

The integration solution also includes an important security component – when opening a depositor’s profile in the Custody module, the system automatically checks such clients against financial monitoring lists. This allows for identifying potentially risky counterparties at the initial stage of depository operations.

The implementation of new functionality allows banks to significantly optimize their depository accounting processes. Instead of double data entry in different systems, employees now work in a unified information environment. Automation of commission, penalty, and fine calculations along with payment control ensures accounting accuracy and timely receipt of service payments.

The next stage of module development plans to implement automated generation of notifications to the State Tax Service about opening and closing securities accounts, which will further expand the system’s functional capabilities.

For additional information about CS::Custody solution and other products, please send a request to: [email protected]