20 Oct 2023

![CS Became the Technology Partner for Moldindconbank's IT Landscape Transformation [CS Became the Technology Partner for Moldindconbank's IT Landscape Transformation]](https://csltd.com.ua/media/cache/news_thumb_big/uploads/images/653288b9db3da056931245.png)

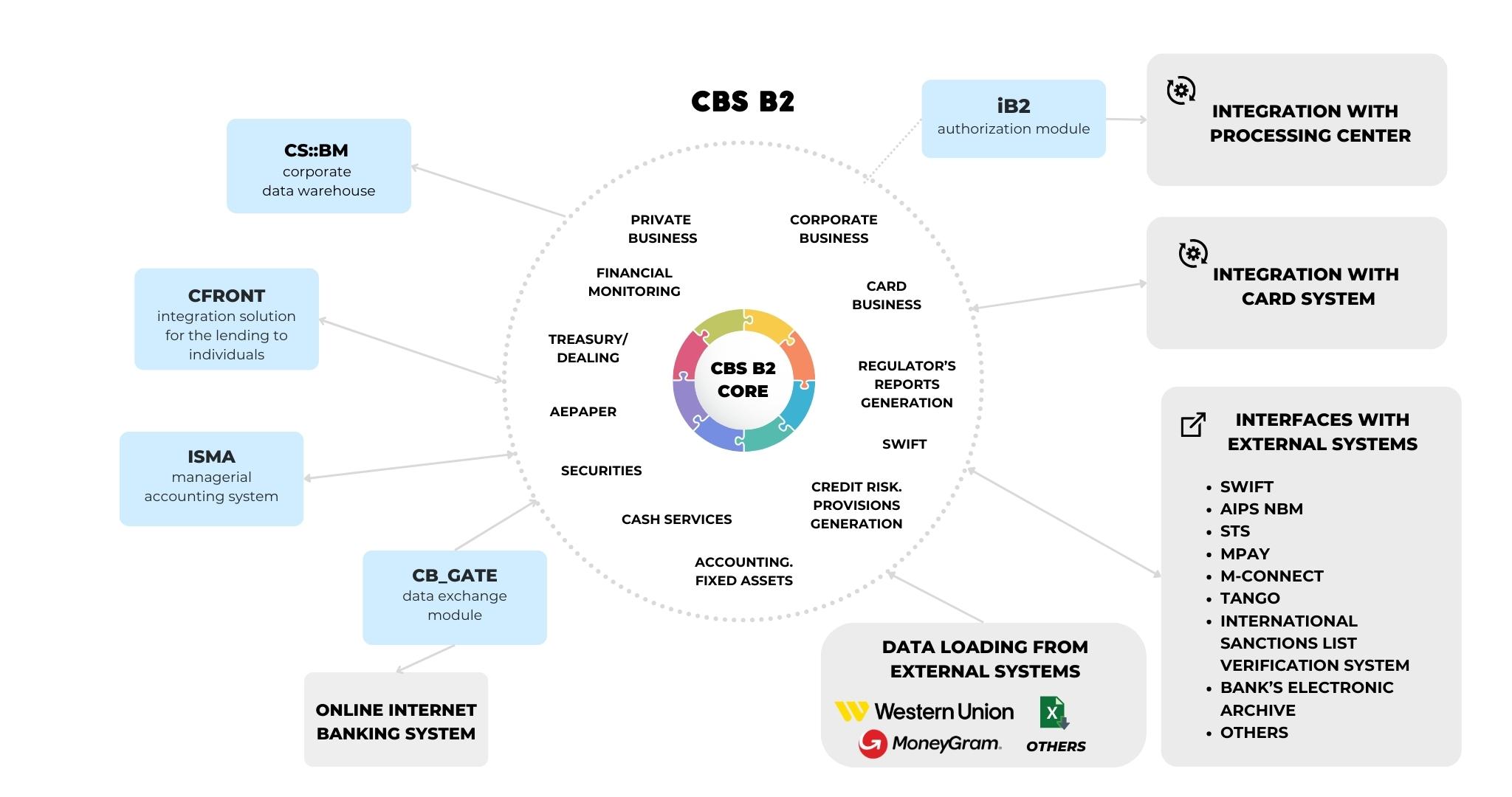

The CS company has become the technology partner for the first phase of a large-scale transformation program at Moldindconbank, one of the largest systematically important bank and leader in cards business in the Republic of Moldova. As part of the IT landscape modernization, a migration to the core banking system B2 was completed, and a suite of software products was implemented.

THE CHALLENGE

Moldindconbank: the course of transformation

In 2021, Moldindconbank (the Republic of Moldova) embarked on an ambitious transformation program named MICB4YOU. This initiative was a cornerstone of the bank’s strategy to invest in digital technologies and foster an environment receptive to innovation. The transformation aimed at optimizing the operational model and overhauling the IT landscape to enhance productivity, efficiency, and alignment with top international banking practices.

The bank held a tender to select a provider for a new Core Banking System (CBS) with the objectives of:

- simplifying the architecture and reducing the number of information systems;

- aligning automation solutions for banking activities with modern standards;

- reshaping business processes;

- optimizing costs for the development and support of the bank’s CBS.

As a result of the tender, CS was selected as the provider of the Core Banking System and other technological solutions.

SOLUTION

The CS and Moldindconbank's teams devised a plan to modernize the bank's IT landscape. The primary objective was migrating to the B2 core banking system with a B2ng web interface.

Important elements of the project included the integration of the CBS B2 with external systems, including card-processing system. The project also encompassed integration with various governmental digital solutions and the implementation of a suite of CS solutions. These solutions comprised a corporate data warehouse and a scoring system.

During the project's execution, we employed a specialized banking system for incident registration, ensuring transparency and promptness in addressing emerging issues.

Our team adhered to strict Service Level Agreements (SLAs) for incidents within this project. This adherence not only guaranteed timely responses but also maintained a high level of quality in the project’s execution.

The launch of the solutions into production involved the CS expert team, both onsite and remotely. This team included top-tier analysts and developers – the CEO and the system architect – enabling swift responses to arising challenges. From the day of migration and for the subsequent 10 days, round-the-clock system monitoring was conducted by the DBA & DevOPS teams.

The bank enlisted KPMG Advisory for assistance with overall program management.

The transformation project of Moldindconbank's IT landscape, from pre-project to the launch, was accomplished in 26 months.

PROJECT RESULTS

Moldindconbank's transition to the CBS B2 was accompanied by significant changes in the configuration of its IT landscape and business processes:

- In the CBS B2, nearly all back-office operations related to card services were migrated from the card system. This migration included card issuance (card back-office), logistics, payroll processing, card loans, and acquiring.

- As a result of the consolidation of the branch network, the bank transitioned to a unified balance in CBS B2, establishing a unified financial institution.

- Regulatory reporting is generated in CBS B2. To date, more than 140 automated reporting files have been implemented for submission to the regulators, as well as to the Deposit Guarantee Fund, the Bureau of Statistics, and others.

- The implementation of the CBS B2 "Financial Monitoring" subsystem was accompanied by:

- The introduction of a scoring system for calculating risk levels, featuring automatic online calculation;

- The automation of reporting files in accordance with the new resolution No. 314-317 (8820-8823) dated 15.08.2023;

- The development of a flexible mechanism for configuring scenarios for selecting documents online and offline, as well as the creation of a consolidated form for the bank's analysts to work with these data cases;

- Integration with the external international sanctions list verification system.

- The implementation of the CFRONT integration solution for the lending to individuals.

- The implementation of the iB2 authorization module for online integration of CBS B2 and the processing center.

- The implementation of the CS::BM corporate data warehouse.

- The consolidation in CBS B2 of information from various sources (deposits, cards, client debts not accounted for on the bank's balance, etc.).

- The replacement of a series of local integration solutions.

- The implementation of elements of the ISMA management accounting system.

Additionally, our company developed interfaces to facilitate efficient interactions between Moldindconbank and the systems of governmental bodies of the Republic of Moldova:

- An automated interbank payment system of the National Bank of Moldova – AIPS NBM for quick and secure exchange of payments.

- Mpay – the government electronic payment system, ensuring the reception and processing of payments from CNAS on National Office of Social Insurance benefits in the file exchange mode, with registration of credit for each entry or denial of payment credit in case of errors (seizure, account blocking, or any other reasons).

- The State Tax Service of the Republic of Moldova (STS). The interface with the Tax Service of the Republic of Moldova is implemented through the nationwide SIA CCDE system. The online interface operates around the clock using the SOAP protocol. During the pilot operation, the daily volume of processed documents averages more than 330 incoming files and 3,100 outgoing files.

- The State Database (M-Connect). The online interface allows for the retrieval of data on individual clients. Secure utilizing this interface simplifies and accelerates the client onboarding process in the system and enables the verification of the validity of documents.

CS Software Products in the IT Landscape of Moldindconbank

VOLODYMYR OLEFIR, Project PM, CS:

“The project at Moldindconbank is in many ways unique. Let’s start with the fact that this is the largest bank in the history of CS company, with 70 branches, 88 agencies, and 262 ATMs where CBS B2 was launched in a one-step transition mode. It’s also the first bank in the Republic of Moldova using CBS B2 for generating regulatory reporting.

An additional challenge of the project was the decision to perform the transition to a unified balance in the new CBS and card system. Transferring all back-office operations related to card transactions to the new CBS was also challenging.

The bank's transition to CBS B2 went exceptionally smoothly and without significant issues: we didn’t notice any delays in executing interbank payments or transactions on card accounts. The reconciliation of balances on card accounts shows insignificant number of discrepancies per day with volumes of over 1 million card accounts. Moldindconbank makes pension and other social payments to the population on the first working day of the month, amounting to hundreds of thousands of transactions. Despite substantial changes in the bank's IT architecture, mandatory social payments were fully completed by the end of the first working day on the new CBS.

There are still many tasks ahead: from solving current issues to implementing software products in the second phase of the transformation program.

We are grateful to Moldindconbank and its team, and the KPMG team for their unwavering belief in success, progressive approach, and active participation in the project implementation. The outcome of this project is an excellent tangible example of the team's professional work from all its participants.

Of course, it’s worth noting the bank's management, which was actively involved in delivering the project, solving key project issues at the highest level, especially in its final stages – UAT and preliminary acceptance. The decision to start was made by the bank's board judiciously, considering existing risks and ways to minimize them.”

MIHAIL IOVU, Deputy Chairman of the Managing Board, Moldindconbank

We are thrilled to have successfully launched our new CBS in collaboration with our partner and help from the KPMG Advisory. This project make a significant milestone in our Bank’s history. Seamlessly transitioning to the new CBS in one swift move we have set a benchmark for efficiency and innovation in the banking industry.

While we acknowledge the achievements of this project, we remain committed to addressing ongoing tasks, resolving any issues, and implementing software products in the next phase of our transformation program. I extend our heartfelt gratitude to CS Company and its dedicated team, the KPMG team and our staff for their unwavering belief in the success of this project, their innovative approach, and their active involvement in its implementation.

We look forward to continued collaboration and further successes as we embark on the next phase of our journey together.

![[CS Ltd]](/images/logo.png)